Examine This Report about Medicare Advantage Agent Near Me

Medicare Advantage Agent Near Me Fundamentals Explained

Table of ContentsMedicare Advantage Agent Near Me - Questions5 Simple Techniques For Medicare Advantage Agent Near MeThe Ultimate Guide To Medicare Advantage Agent Near MeThe Best Strategy To Use For Medicare Advantage Agent Near MeIndicators on Medicare Advantage Agent Near Me You Need To Know

Based on our evaluation, the ordinary premium in 2020 for Medigap was $1,660, indicating a representative would be paid $322 for the very first year and $166 as a renewal compensation. Since premiums and also price adjustments for policies can differ, commissions may change based upon recipient, policy, and area. Insurance providers likewise may make added repayments, in enhancement to enrollment payments.These activities might consist of advertising, technology, training, as well as compliance; the agencies function as an intermediary between representatives and also insurance providers. Unlike registration compensations, management payments are not set by any kind of regulating or regulatory body; instead, they are set by insurance companies in negotiation with each independent agency. For MA as well as Component D, CMS's Medicare advertising guidelines establish that these payments "need to not surpass FMV or a quantity that equals with the amounts paid to a 3rd party for comparable solutions throughout each of the previous 2 years." These settlements provide an additional channel of economic assistance between insurance firms as well as firms as well as representatives.

The 15-Second Trick For Medicare Advantage Agent Near Me

MA and also Part D plans are determined with the star ratings program and are made up in different ways for providing a high-quality participant experience (Medicare Advantage Agent near me). Guaranteeing commissions even if beneficiaries remain with their initial plans may assist avoid unnecessary changing.

Policymakers might consider specifying a minimal level of service needed to make the renewal or switching payment. Agents are an important source for recipients, yet we need to reimagine compensation to make certain that incentives are much more very closely straightened with the purposes of providing guidance and advise to recipients as well as without the threat of competing monetary interests.

Fascination About Medicare Advantage Agent Near Me

It prevails for people trying to find a brand-new health insurance strategy to experience an insurance policy agent, yet is this essential when it comes to Medicare? The circumstance will vary depending on the kind of Medicare you desire (Medicare Advantage Agent near me). If you do choose to go with an agent, the information can still make the procedure differ extensively.

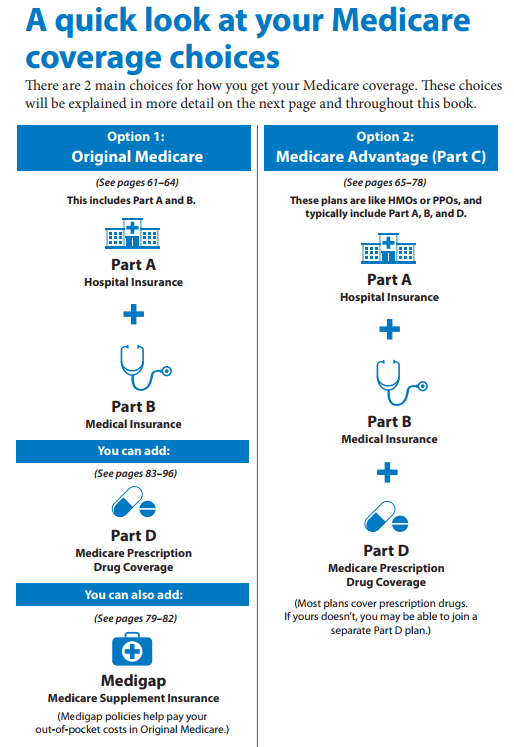

If you're simply planning to register in Original Medicare (Medicare Components An and also B), after that you won't need to use an insurance policy agent. Actually, you will not be able to utilize an insurance representative-- this kind of Medicare is only available from the federal government. Insurance coverage representatives will never enter the picture - Medicare Advantage Agent near me.

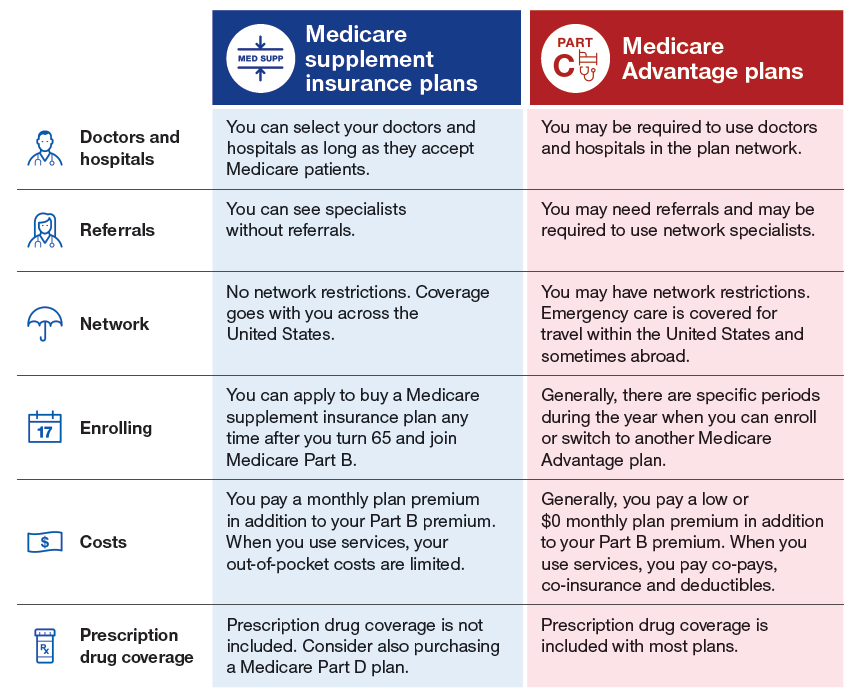

This is since Part D plans are marketed by personal insurance provider. Medicare Advantage is by much the most typical type of Medicare insurance that is offered with insurance policy agents. Medicare Benefit plans, also called Component C strategies, are basically a means of obtaining your healthcare protection through a private strategy.

What Does Medicare Advantage Agent Near Me Do?

Some Component C plans come with prescription medicine strategies bundled with them, and some do not. If your own does not come with a PDP, directory then it can be possible to get Part C from one business and also Part D from another, while collaborating with two separate representatives for every strategy. Medicare Supplement prepares, likewise called Medigap strategies, are strategies that cover go to my blog out-of-pocket prices under Medicare.

These strategies are likewise marketed by private insurer, which implies that insurance policy agents will be able to offer them to you. When it comes to Medicare insurance policy agents, there are usually 2 kinds: slave as well as independent. Both can be accredited to market Medicare. "captive" has a really unfavorable undertone, it is just utilized to refer to agents that work for just one firm, instead than agents who can function with a range of insurance coverage companies.

The basic manner in which you can consider captive versus independent representatives is that captive agents are sales agents who are gotten to market a details insurance policy product. Independent representatives, on the other hand, are much more like insurance coverage brokers, suggesting that they can market you any kind of kind of insurance policy product, and aren't restricted to one business.

An Unbiased View of Medicare Advantage Agent Near Me

As you can envision, there is a much better degree of freedom that features collaborating with an independent insurance representative instead of a restricted one. Independent representatives can consider every one of the insurance policy items they have accessibility to and look why not find out more for the one that functions ideal for you, while captive representatives can only offer you one particular point, which may not be a good fit.

Independent agents can simply locate another strategy that fits your demands better. Based on the above, independent agents appear plainly premium to restricted agents. You might be questioning why any person would certainly ever choose a captive representative. There are only two major reasons for this. First, an individual may have already done their study as well as understands which plan they want and which rate they desire to pay.